Why is a picture of St. Barts here? Keep on reading. It doesn't really apply but is referenced! Why is a picture of St. Barts here? Keep on reading. It doesn't really apply but is referenced! Last week a client asked me about Michael Burry's claim that index funds are about to burst. Michael Burry was one of the few major investors who correctly predicted the 2008 market crash. Should we listen to him? More than a few thoughts: 1. Take Market Guru Advice with A Grain of Salt On any day, I can find two market gurus who give opposing statements. Michael Burry might be considered an investor and not a guru, but he's still producing news-worthy articles outside of a research body. One has to ask the question - are they trying to sell a product (even themselves as a product or their TV/Radio show) or influence the market in a certain manner? I'm always cautions - I try to base my views and recommendations on independent analysis. I've covered this before, and my view won't change. This isn't always possible, as some of the firms have larger research funds than independent bodies. The Wall Street Journal tested a theory that a blindfolded monkey throwing darts to select stocks would do better than market pros. Apparently they didn't use actual monkey's for liability reasons. 2. Burry Doesn't Disclose Everything, and Not in Real Time Take a look at a few articles following Burry's investments. One key area he doesn't disclose: his short positions! And note these are post-disclosures! Burry made his fortunes in shorting the US market, not finding companies which were going to grow. Thus, I'd really like to know these short positions. As a hedge fund manager, Burry can do pretty much anything he decides and disclose holdings later. As such, he can "hint" at his actions but keep his cards hidden. Will this hint influence the market? Maybe not, but if were a hedge fund manager and had an inside look at the economy, would you announce it for public information or for private motive? https://whalewisdomalpha.com/michael-burrys-scion-13f-holdings/ https://whalewisdomalpha.com/michael-burry-scion-asset-management-q1-holdings/ https://www.bloomberg.com/news/articles/2019-09-05/burry-s-picks-of-undervalued-japanese-companies-rise-in-tokyo https://finance.yahoo.com/news/michael-burrys-3-favorite-stocks-192030591.html https://www.sec.gov/Archives/edgar/data/1649339/000156761919010955/xslForm13F_X01/form13fInfoTable.xml 3. Passive Funds Don't Own the Market While they own a good portion (nearly half US equities in 2019), active still controls the other half. If the passive funds did own a majority of the market, would this be of concern? I'd suggest not - did anyone raise these concerns when the active funds controlled 90% of the market? It is a different issue, but worthy comparison for this napkin-test (wait, this is longer than what would fit on a napkin). 4. Does the Tail Really Wag the Dog? Market Liquidity Issues? Passive only Generates Alpha? Efficiency? The key question is will indexing itself influence the market, and if the market was 100% passive how would pricing matter, and does passive investing create inefficient markets? We are still a long way from that point - but yes, it could happen. At 100% passive, there would not be competitive market pricing. But that's what is great about the market - there's no way it will be 100% passive as someone will always be out there trying to beat the market. It is a shrinking population, but until that point. Some argue that indexing makes up only 5% of the market (as of 2016) - that's not enough to be of concern. I'll buy into the liquidity issue in a few select time frames - if the market was mostly passive and all passive investors rush the market, there's a liquidity issue. Would the active managers have enough to purchase these (at this point low cost) funds? Perhaps. But one could argue that if passive indexing, particularly with dollar cost averaging and a "set it and forget it" mindset, was the norm, market liquidity would be better during a bear market. Someone needs to do a study on this...or send me one already done! 5. This Concern Isn't Old Yet another hedge fund manager, Seth Klarman, said in his book back in 1991 that passive investing would be a fad. And what has happened in the last 28 years? Exactly. 6. Sales Technique from Active Fund Managers Who's screaming this issue? That's right...always active fund managers. They have to make noise, as they are consistently under performing the market. Check the latest SPIVA data here: https://us.spindices.com/spiva/#/reports 7. A Major Economic Issue? Are We Headed Into a Downturn? Finally, we come to the root issue. Has the massive growth in passive investing caused the market to be overvalued? Yes, this could occur, and yes, we could be heading towards a downturn. Is this a reason in itself to adjust back to active management? No, not a move to active, as if the market is overvalued, I still believe in the monkey stock selection vs. an active manager. I'm a 80% core advisor and investor, but that does leave some room for an active role. The economic question is a larger issue than this blog post, but for a short answer: I concentrate on is asset allocation, risk, which some argue (and I mostly agree) over the long term predicts nearly all of your investment returns, and do not time the market, because no one can perfectly. Risk tolerance matters, as does time frame: are we investing for the next market cycle or for retirement in 20 years? This said, I often look into alternative investments for clients, everything from rental properties (who wants to buy a villa in the French East Indies...I'll happily manage it) to small businesses (storage units in my area are making a killing) and many ideas in between. I'm not an alternative investment junkie, but I do allow 20% of my assets to be in non-passive investments. Is the market overvalued? Yes, I believe so and conventional wisdom (i.e. most fundamental analysis) says so. Is this itself a reason to pull out? If we knew the timing, yes. But remember, even God can't time the market, and attempting to will do worse than buy and hold. Ok, maybe God can, as long as we are in monotheist.

1 Comment

Estate planning - it's not one of the most exciting topics to cover but is necessary. Tax planning, legal documents, investments need to be reviewed. I'm going to cover something else: organization. Yes, simply organization. For married clients, typically one of the spouses handles investments, billing, taxes, and other business matters. It is the same in my household; Ioana (my lovely wife) knows who our local bank is, but likely would have to dig through files or piles of papers to find whom our investments are with or mortgage. Is this a problem? Only if I am not organized. With single individuals, the executor or power of attorney likely is unaware of minor details. 1. Create a financial inventory listing all accounts, including debt, investments, bills to pay, insurance, and any other critical item. If you can think of it, include it. Add important contacts, including estate attorneys, accountant, financial advisor, and insurance agent. If you have other important notes, include these, especially items where you receive emails/electronic statement. 2. Ensure your legal documents are in order, and include copies with the financial inventory. 3. Review these items with critical members of your family or estate team. With married couples, these documents are usually reviewed with the other spouse, but not children or executors. Ideally these would be reviewed with children or your trusted executor. Who else wants to review estate documents and accounts over thanksgiving dinner? Ok, perhaps that is not the best timing. 4. Place these documents in a secure location, either a safe deposit box or small safe. There are plenty decent options for under $75 - as long it can be installed permanently and fireproof, it should be good enough to keep items secure, and safe deposit boxes are worth the cost if you are concerned with theft. 5. Review these documents whenever there is a significant change and every February 1. Why not at the end/beginning of the year? Because that is a busy enough time to worry about estate needs! The date does not matter - just make it consistent. In the end, if something were to happen to you tomorrow this packet should have all of your important to allow your family or trusted executor to easily handle your business items. Categories

Hi, my name is Chris Spargo, it’s a pleasure to make your acquaintance! I’m new writing here at the Sherman Financial blog so I thought I’d take the opportunity to introduce myself, and while I’m at it, hook you up with some simple advice that could save you a lot of money in your taxes. It’s mid-December and if you’re like me, you’d much rather be reading Charles Dickens with some Bing Crosby in the background, but don’t forget – nothing says Merry Christmas like big savings on your taxes! Let’s take at look at these four user-friendly, end of the year tax-saving strategies. 1. Deferred IncomeThis one is simple. It’s December. If your customer or client pays you today you will owe taxes on that money this April. But if they pay you January 1 or later your taxes will not be affected… at least for this year. Why is this useful? Perhaps you’ve had an especially good year and are teetering toward the top of your tax bracket. If you receive that payment it might put you over the edge – all that money will be taxed at an unfortunately higher rate! What if next year you aren’t expecting your income to be quite so high? Ah – bingo! Bill that customer late in December or in the new year and voila! You will receive the full payment at a lower tax rate. This trick isn’t always helpful – but for many people it’s a very valuable way to reduce taxes. 2. Sell Losing Investments to Offset GainsIf you have investments this is a biggie. AS YOU KNOW if you made any gains on good investments this year the US government will surely tax it. But DID YOU KNOW that if you made losing investments then you can go ahead and sell, sell, sell them away and for every dollar you lost on said investment it will offset gains from good investments dollar for dollar. Let me repeat myself – dollar for dollar! Amazing. Maybe you only made bad investments for a loss. Well I’ve got good news for you. You can use up to $3000 of those losses to reduce taxable income. Stunning. What if you lost over $3000? You can carry over those excess losses to the next tax year to offset investment gains or reduce taxable income. Two words from Uncle Sam, “Merry Christmas.” And the moral of the story is – sell those losses! Reap your tax benefit and if your heart is set on it then buy the investment back in the new year. 3. Contribute to Your Retirement Account Many companies offer 401(k) retirement plans where each year your employer will match every dollar you put into your retirement account (up to a limit, everybody’s got their limits). We are at the end of the year, therefore I would remind you to consider putting what you can into the account – it will only make you richer. If you are one of Sherman Financial's clients and have not maxed your 401(k) at least to the match, well then we need to talk. 4. Take List Minute Tax DeductionIf you plan on itemizing deductions then please remember to give, give, give to charities, churches, and non-profits of your choice. If you’re intent on giving don’t wait for the New Year’s ball to drop! Give today and save on your taxes tomorrow. Here’s a pro tip: you can donate appreciated stock and property for big tax benefits. If you’ve owned the stock for over a year you get double the benefit. Whaaat? And for property, you can deduct the properties market value on the date of the gift. Better yet – because you’re gifting this asset, you avoid paying capital gains on the built up appreciation!! This is a true pro tip and it’d warm my heart this Christmas if it saved you a lot of money. Enjoy your holiday.

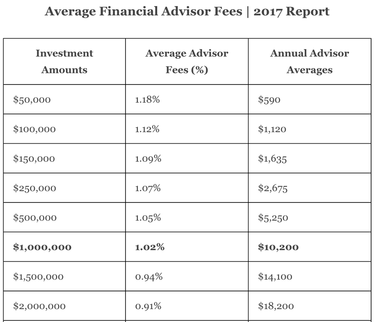

Use those savings to fill your houses with cheerful gifts and succulent roast turkeys. Wishing you and yours a Merry Christmas and a Happy New Year. In my last post I described how Asset Under Management (AUM) compensation does not relate to hours worked. This post describes how AUM compensation may have the opposite effect on your portfolio - the advisors may have motivation to doing something not in the client's best interest. If this isn't a conflict of interest then I'm not sure what is! Investment advisors should be "fiduciaries" - someone who manages another one's assets. This sounds great - however what if this fiduciary has a "stake in the game" or a benefit to managing the assets in a certain manner which may or may not be in the best interest of the owner? Even the news is raising this question. Remember a "financial advisor" is someone who is legally allowed to give a recommendation on what financial product to invest in. How they come to this recommendation can be dependent on their compensation.

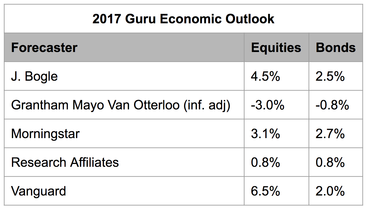

For the purpose of this discussion, let's assume a 1% AUM fee and there are no commissions or sales-based charges. That's a big assumption as there are plenty of commission or sales-based charges in the financial world. But for sake of argument let's forget those for now. 1. Getting (and keeping) funds under management Advisors who are paid by AUM have motivation - not to provide the client with best information, but to maintain as much funds under management as possible. See the following examples: A. You have a handful of investment accounts, including a 401K with your current employer, an IRA and taxable accounts with the advisor, and a small taxable investment account at a discount broker. You have $20,000 to invest this year for retirement - the AUM advisor would receive an extra $200 per year if you invested with him/her. Would they suggest to invest with them or through your 401K or independent account? If you raise the idea of placing it in your 401K they could argue not to due to minimal fund options, decreased flexibility, poor past performance. All of these may be valid reasons, but the additional $200 additional they will receive if it was in their AUM account gives them motivation to invest with them. B. One of your goals is to pay off your mortgage before you retire. You have adequate funds to do this in your investment account with your AUM advisor. Would your AUM advisor benefit from telling you not to pay off your mortgage? Yes! The advisor will argue that you will likely earn 5-8 percent on the money if you keep it invested verses the mortgage with a rate of usually 3 - 5 percent, and the mortgage interest tax deduction. Theoretically they are not in violation as a fiduciary, as these are all valid reasons not to pay off the mortgage. But if debt makes your skin crawl and you do not want the mortgage burden in retirement, you would want an advisor who gives you a recommendation free from their personal motivation. IA financial advisor receiving a fee bases on AUM may not look at the psychological and emotional aspect, they will look only at the fiscal aspect of your situation. C. You have a desire to make a charitable donation. As the stock market is up, you have equities that have appreciated in value, and if sold would incur a significant tax liability, in donating the equities you will incur no tax liability. You also have the cash available to donate. You ask your AUM advisor about the donation. Will the advisor tell you to sell in following "buy low and sell high" and donate the equities? Or will they state the stock is doing well and to ride the current gains and use cash? Remember donating the equities would decrease the AUM account size, thus decrease advisor compensation. The ideal solution is to donate the securities and repurchase with the cash you were going to donate. You avoid the tax penalty, and the new basis (which future taxes are based on) will be the new, higher price. Instead of purchasing the new equities with the advisor (where you will be paying AUM management fees), doing it outside of AUM fees but under the advice of the manager would produce lower fees. 2. Active management If you take nothing else from this, remember that active management often produces lower returns than passive management - feel free to read the SPIVA scorecard for the exact figures. Advisors may show reports of portfolio return or comparisons to other funds. The question should be "how did my portfolio compare to the market overall with consideration for asset allocation". Indexes selected for the comparison can frame return - for this reason I prefer to use risk/metric returns for comparisons. See my previous post on this issue for more information. Other than being placed in active funds, trading can be done to "prove" the advisor is doing work. When I do 6-month and yearly reviews, my clients are often surprised of me not making transactions. They are used to their advisor suggesting constant moves to keep up with market conditions. Remember, the SPIVA research proves that active management rarely, if ever, beat passive portfolios. 3. Complicated portfolios I had a client who's previous advisor had them in 15 mutual funds within a single account. The overall portfolio had nearly 50 different funds. This may be interpreted as diversified, 15 funds is not needed for diversification. Remember a mutual fund is already diverse - 15 funds in a single account is a bit overextended. The advisors may have done this to create complexity and confusion where the client will rely on (and maintain an advisory relationship) with the advisor. 4. Custodian and Broker-Dealer Relationships These can be the worst for the investor. The advisor is a representative of an investment firm or bank. Your funds are held at the firm (custodian), where trades are conducted (broker-dealer) and advice is received (financial advisor). Many advisors with this styles recommend, either majority or solely, their firm or banks funds or another company whom they have a relationship with. Read that again - the advisor often cannot recommend what is best for you. The question to this is why would they only recommend funds from their firm. Is this best for you or for the firm? I'd suggest it is due to high fees on the funds or sales charges. There are advisors who work under a custodian/broker-dealer relationship who are not required to recommend their firm's funds, however the are typically still at the AUM level. What about wealth based advisors? Wealth based advisors charge a fee based on client wealth, not assets under management. This can eliminate some of the conflicts of interests. This is a step in the right direction, and many AUM advisors have rightfully gone to a net-wealth based method to avoid AUM fees. However the question of compensation based on net wealth still remains - does a larger portfolio require more hours needed? Does a $1,000,000 net wealth client require less time to manage than a $1,500,000 net wealth client? I'd suggest no. What about an hourly advisor creating a complicated portfolio/plan, requiring many hours needed per year? This definitely could occur, and is my conflict of interest. Theoretically I could "pad" my hours. Think for yourself - should it take Sherman Financial 5 hours to manage my account? 10 hours? How much time is actually spent on my account? I'd ask you to compare fees with those of AUM advisors, including portfolio expenses (expense ratios, and sales charges). Yes, this takes some work on behalf of the client. Does an AUM advisor whom does not charge an advising fee have higher portfolio cost expenses than what a flat-rate/hourly advisor charges, and does this AUM advisor give better returns? Will the advisor who's not paid a flat rate give me the best advice? It's a bit to ask you to do (perhaps even do some math!) but is your account worth the work? This concludes my first and hopefully only post with all text - I promise memes, cartoons, graphs, and maybe videos in the next post!  AUM fees from Advisory HQ research: https://tinyurl.com/y94c65b8 AUM fees from Advisory HQ research: https://tinyurl.com/y94c65b8 Recently I had a tax client ask about their investments with another advisor, particularly advisor fees. The advisor's website, nor their required Form ADV (the disclosures with a clear explanation of fees an investment advisor is required to give to clients) had a clear explanation of fees. I called the advisor and asked "what are your fees ". Their response was it depends on the client and their situation. Read that one more time - it depends on the client and their situation. What this means in advisor terms is the fee is based on clients wealth or assets under management. The advisor then described their fee structure for the client - 1% base minus a discount for family/friends/high net worth. Thus, a $200,000 client would pay $2,000 per year, a $1,000,000 client would pay $10,000, excluding discounts. There are a number of methods to calculate the fee - all based on assets under the advisor's management or based on net wealth. My wife is a music teacher and charges a rate per hour worked. We think it is a fair rate, one the market will support and one that does not overcharge the clients. For those low-income students there are scholarships available if they apply and meet certain requirements. If she structured her rate based on a AUM/net worth rate, the rate would be one of the following: What is your net worth? We charge 1% of net worth per services, regardless of how much work we actually provide. Would anyone do this? Perhaps the lowest income earners, but it would not be equitable to middle or high income earners. Asset under management fees are based on exactly that - assets under management. The fee has nothing to do with the amount of work the advisor provides. To an advisor, the amount of assets often has little to do with work provided - in fact it is often the opposite. Does it take any more time to review a $2,000,000 portfolio than a $200,000 portfolio? No it does not! In fact when I give potential clients quotes, my quotes are based on complexity, not AUM, net wealth, or any other factor not linked to how much work I will need to put it. Many advisors state they are fee-only. There are professional advisor organizations for "fee only". These advisors are "fee" only as in they receive no outside compensation, such as commission or sales fees. A better question is what is that fee based on. Is it based on net wealth? AUM? Flat rate? Hourly? Sherman Financial will never charge AUM or net wealth fees. Yes, I might charge wealthier clients more due to them having additional work (often business interests, trusts, accounting needs, AMT issues, etc), however it is never based on the funds invested. A client with over $1 million in assets could be simpler to manage than one with $200,000. Does the fact they have more money mean they should be charged more? Not based on work provided. Some of you may be thinking that a flat fee means you have to pay high hourly rates for advisor services. This may be true - I'll admit I have a fee you must pay. If you have little or no assets then you very well may be better off at a AUM advisor. Thus there is a point where I cannot compete with low-sized portfolios, and I'll accept that. That's enough ranting for today. The next post will be on how AUM fees may not be providing information in your best interest. It's been a while since my last post! No, I have not been on a mega road trip although I've dreamed about completing the Trans America Trail and The Great Loop. At nearly every client meeting, the issue of "market noise" comes up. The client hears that Bitcoin is taking off (or falling off the cliff), oil prices are increasing, the market is overvalued, or taxes have changed significantly. While some of this may be true, market noise can get in the way of your financial and emotional health. Take the 2017 market expectations. At the beginning of 2017 I presented my clients with the following chart, as everyone wants a crystal ball and one gauge is using the gurus expectations. Unless you have been on one of the mega trips noted above, you would know the market has well exceeded these expectations. Does this mean I want you to ignore news and "experts"? No, but the news and these gurus need to be treated for who they are - non fiduciary, and non financial professions who are not in your best interest (their goal is to sell ads and books). One method I use is to confirm all information. The Jerusalem based marketing consultant Joseph Sherman (who happens to be my brother) has taught me to always read the original source material and compare multiple opinions of the source material. I'm not sure if he ever reads the news and instead gains information from official government and business reports and derives an opinion free from market noise - this might be an extreme example, but imagine if we did do this. If you do have an important news item please forward it to me! Like this article by Scott MacKillop of First Ascent Asset Management, who covers this topic further. Market Response - Do I Read The News At All?

Recommended Reading I'm doing my best to use actual source material to not contract myself!

The Fiduciary DifferenceI know my clients have many options when choosing a financial advisor. SEC Fiduciary Defintion A fiduciary advisor, puts their client's interest first. The DOL is forcing advisors of retirement accounts into a fiduciary structure - I'd ask if you really want to work with someone who was forced into it? Recommended Reading1) 6 Ways President Trump's Tax Proposal Could Change Your Taxes

2) Even amateurs are writing articles about why you should not be using AUM and high fee funds 3) The three mistakes preventing you from beating the market - this is now required reading for all of my clients! 4) For my non-financial post: it's nearly summer, time to take the kids camping. One of my life goals is to teach Luca into loving the outdoors like I do. Here's how.

Understanding Risk (and why performance alone is not my first concern)A key component of any financial plan is risk management. Investors want to maximize returns while minimizing risk. While different funds may offer similar returns, differences in risk can mean one is a great investment, while another is not. Risk relates to return, and when comparing either a stock or mutual fund it is important to see return in comparison to relative risk measures. An active fund with a 15% return over the past year may seem great on the surface, however the return alone does not tell us how this 15% compares to other funds and the market overall. I often see client statements filled with only annual return graphs and figures. I want to give a full picture - that's why I include risk and return metrics in my reviews. I look at a number of indicators including, Alpha, Beta, R-Squared, the Sharpe Ratio, and Standard Deviation when recommending investments to ensure they are appropriate for an individual's client risk tolerance and fit within their broader financial plan. The risks of stocks, mutual funds and other similar securities are measured with statistics. The actual performance of a security is compared to a bench mark to see if the investment performed as expected. Different investments have different benchmarks. Some are measured against "risk free returns," often U.S. Treasury Bills. Others are designed to match the performance of a specific index such as the S&P 500 or the market as a whole.

Recommended Reading

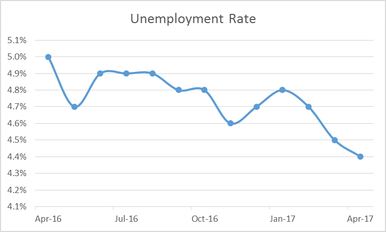

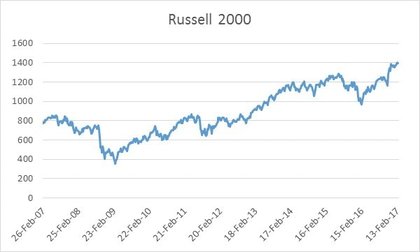

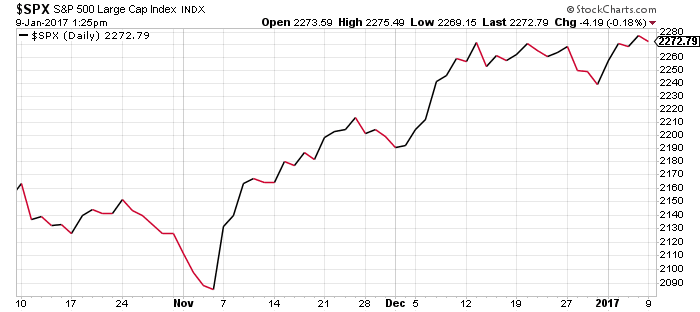

Happy New Year! For many of us it has been a great year, specifically the final quarter of '16. If you stayed patient and followed your long-term goals, you should have reaped solid investment rewards over the last three months. If your returns were not up to your expectations, let's review your plan so that both you as the client and me as the advisor can do the work that ensures you a solid future. S&P 500 3-Month ReturnThe last three months give a good example of why investors should stick to their long-term plans. The market has had a great run and continues to advance despite Brexit, the US presidential election, and interest rate increases. The S&P 500 has earned 11.96 over the past year (ending Jan 9 2017). Compare this to the first two weeks of 2016 — literally the worst first two weeks of a year ever! 2016 HighlightsHealth care and its associated costs has been and will continue to be a significant topic. This study by Kaiser showed that even though premiums had a slow increase, deductibles are higher than ever. Many of those on the Federal Marketplace likely saw an increase for 2017. While it is too early to know how the Federal government will alter the Affordable Health Care law, it is fair to assume that there will be some change to it. My takeaway from this is to ensure you have proper emergency savings to cover unanticipated medical bills. If you are eligible for an HSA, let's discuss how much you can save in a tax-advantaged accuont. Brexit made every headline in June, and for good reason. While this will have an investment impact, I'm expecting the "noise" was greater than the economic market. Interestingly, the market has not responded negatively, and businesses are continuing with their plans. Those with UK-specific investments should monitor them carefully; however, since most of you reading this are not heavily invested in UK equities, I see no reason to be concerned. My biggest headline this year was the Federal Reserve raising the interest rate. This will affect most of us in two ways: credit (loans) will be more expensive, but cash investments will do better. The Feds would have only done this if they anticipated a solid economy to withstand the increase. My Crystal Ball for 2017 |

Follow SFP on facebook to receive weekly updates! facebook.com/shermanfp |

Further Reading

|