|

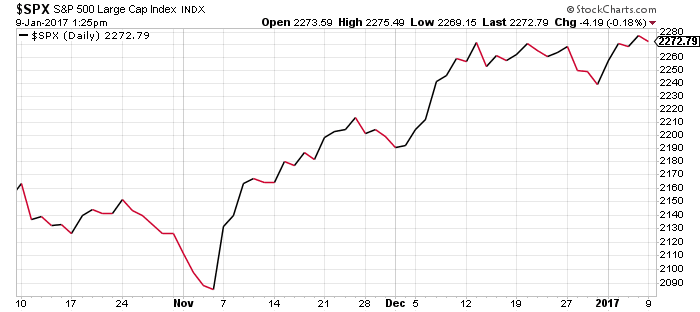

Happy New Year! For many of us it has been a great year, specifically the final quarter of '16. If you stayed patient and followed your long-term goals, you should have reaped solid investment rewards over the last three months. If your returns were not up to your expectations, let's review your plan so that both you as the client and me as the advisor can do the work that ensures you a solid future. S&P 500 3-Month ReturnThe last three months give a good example of why investors should stick to their long-term plans. The market has had a great run and continues to advance despite Brexit, the US presidential election, and interest rate increases. The S&P 500 has earned 11.96 over the past year (ending Jan 9 2017). Compare this to the first two weeks of 2016 — literally the worst first two weeks of a year ever! 2016 HighlightsHealth care and its associated costs has been and will continue to be a significant topic. This study by Kaiser showed that even though premiums had a slow increase, deductibles are higher than ever. Many of those on the Federal Marketplace likely saw an increase for 2017. While it is too early to know how the Federal government will alter the Affordable Health Care law, it is fair to assume that there will be some change to it. My takeaway from this is to ensure you have proper emergency savings to cover unanticipated medical bills. If you are eligible for an HSA, let's discuss how much you can save in a tax-advantaged accuont. Brexit made every headline in June, and for good reason. While this will have an investment impact, I'm expecting the "noise" was greater than the economic market. Interestingly, the market has not responded negatively, and businesses are continuing with their plans. Those with UK-specific investments should monitor them carefully; however, since most of you reading this are not heavily invested in UK equities, I see no reason to be concerned. My biggest headline this year was the Federal Reserve raising the interest rate. This will affect most of us in two ways: credit (loans) will be more expensive, but cash investments will do better. The Feds would have only done this if they anticipated a solid economy to withstand the increase. My Crystal Ball for 2017 |

Follow SFP on facebook to receive weekly updates! facebook.com/shermanfp |

Further Reading

|

0 Comments