|

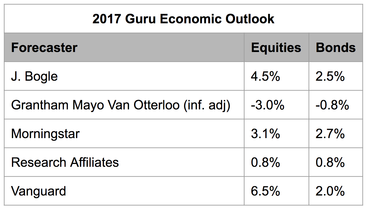

It's been a while since my last post! No, I have not been on a mega road trip although I've dreamed about completing the Trans America Trail and The Great Loop. At nearly every client meeting, the issue of "market noise" comes up. The client hears that Bitcoin is taking off (or falling off the cliff), oil prices are increasing, the market is overvalued, or taxes have changed significantly. While some of this may be true, market noise can get in the way of your financial and emotional health. Take the 2017 market expectations. At the beginning of 2017 I presented my clients with the following chart, as everyone wants a crystal ball and one gauge is using the gurus expectations. Unless you have been on one of the mega trips noted above, you would know the market has well exceeded these expectations. Does this mean I want you to ignore news and "experts"? No, but the news and these gurus need to be treated for who they are - non fiduciary, and non financial professions who are not in your best interest (their goal is to sell ads and books). One method I use is to confirm all information. The Jerusalem based marketing consultant Joseph Sherman (who happens to be my brother) has taught me to always read the original source material and compare multiple opinions of the source material. I'm not sure if he ever reads the news and instead gains information from official government and business reports and derives an opinion free from market noise - this might be an extreme example, but imagine if we did do this. If you do have an important news item please forward it to me! Like this article by Scott MacKillop of First Ascent Asset Management, who covers this topic further. Market Response - Do I Read The News At All?

Recommended Reading I'm doing my best to use actual source material to not contract myself!

0 Comments

Leave a Reply. |

|

© 2024 Sherman Financial, LLC

Disclaimer: Information on this website and blog do not involve the rendering of personalized investment advice. A professional advisor should be consulted before implementing any of the options presented. No content should be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. |